President Biden Chillingly Declares a New World Order

The collapse of World Dynasties, the rush to Central Banking Digital Currencies and the Japanese Legend of the Sessho-Seki

The Radical Dispatch

“Anyone familiar with the Japanese legend of Sessho-seki, or the “killing stone,” should be alarmed following reports earlier this week the volcanic rock has recently split in two. According to mythology, the rock traps the spirit of Tamamo-no-Mae, a deadly and immortal nine-tailed fox responsible for the collapse of dynasties and the deaths of thousands across Asia in ancient times.”

This is the free version of the Radical dispatch. To listen to my accompanying Resistance Radio broadcast please subscribe here:

President Biden Chillingly Declares a New World Order

The collapse of World Dynasties, the rush to Central Banking Digital Currencies and the Japanese Legend of the Sessho-Seki

1) A New World Order

That’s it. The president has confirmed something that, up until now, was laughed at as the paranoid delusions of the “weak” minded, those whose perennial curse is that they see a kaleidoscope where others only see isolated dots. This week, President Biden confirmed to business leaders that we are at an inflection point, and there will be a New World Order. For some reason, he felt the need to couple this announcement with the number of people that he believes usually die when such historic turnings occur: 60 million.

It’s not rocket science. World Orders are built around the financial system. Historically, this would usually only change through war. By way of example, the end of World War II heralded the creation of the International Monetary Fund (IMF), agreed at Bretton Woods. This established the modern financial system by linking global currencies to the US dollar and - at least until 1971 - the US dollar to gold.

“The countries that joined the IMF between 1945 and 1971 agreed to keep their exchange rates (the value of their currencies in terms of the U.S. dollar and, in the case of the United States, the value of the dollar in terms of gold) pegged at rates that could be adjusted only to correct a "fundamental disequilibrium" in the balance of payments, and only with the IMF's agreement. This par value system—also known as the Bretton Woods system—prevailed until 1971, when the U.S. government suspended the convertibility of the dollar (and dollar reserves held by other governments) into gold.”

After 1971, and due to Nixon’s alterations, global currencies remained linked to the US dollar, but the US dollar was pegged to absolutely nothing. This is how - right up until now - the US Federal Reserve had a monopoly on global monetary policy.

Due to greed, corruption and unaccountability leading to the cover up of global mass-embezzlement, our current financial system is in its death-throws. This was largely caused by boom-bust cycles, and our policy responses to them, such as ‘quantitative easing’ or money printing. But unlike after WWII, this time an alternative exists in the form of decentralised crypto currencies.

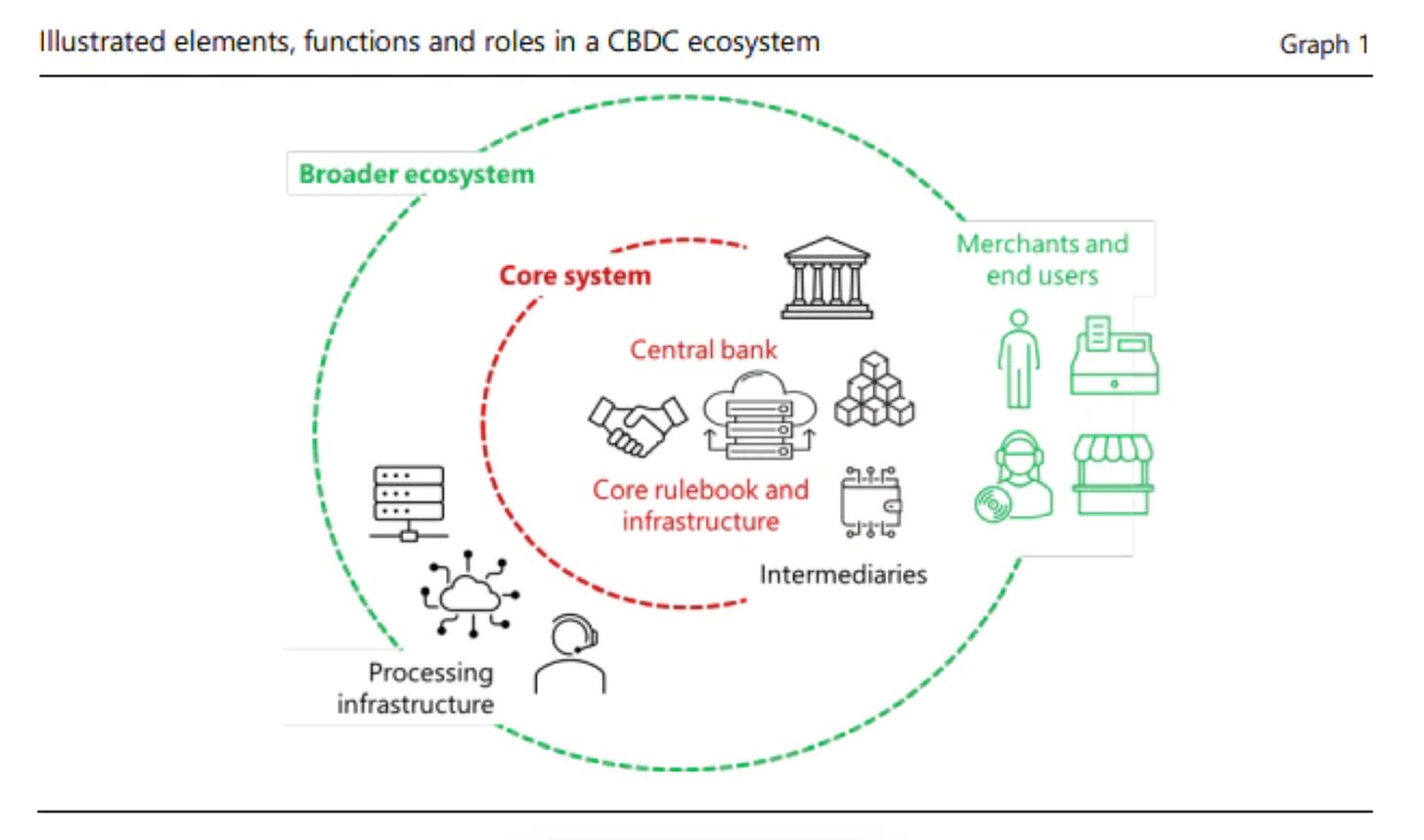

Central bankers are clamouring to fend off the advancement of decentralised currencies so as to maintain their global control, by creating their own centralised alternative: Central Banking Digital Currencies (CBDCs).

Unlike Bitcoin, and although also issued on the blockchain, these CBDCs are in fact digital coupons (they call it “currency”) controlled by central banks.

2) As If In Lockstep - Because They Are In Lockstep

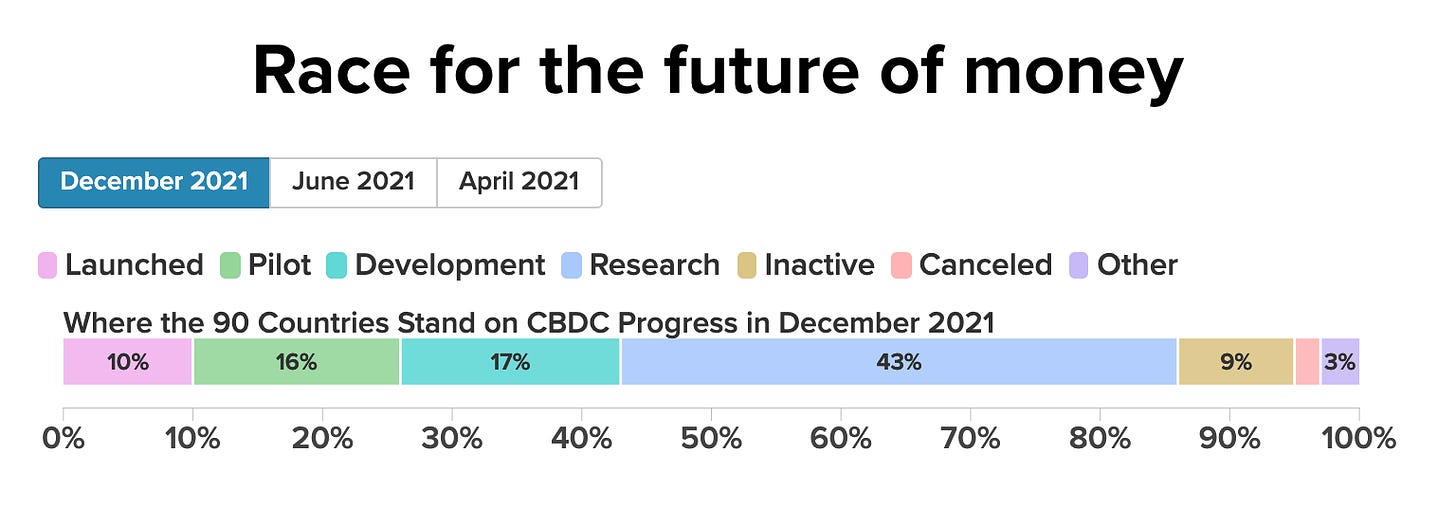

As I warned in my interview with Joe Rogan (censored for three weeks), countries around the world have already started to roll out their CBDCs.

i) The United States

This month, President Biden issued an Executive Order that paves the way for an American CBDC.

This order calls for a full-scale assessment of the potential benefits of, and risks associated with a CBDC. It orders the US Treasury Department, the Commerce Department and other agencies to prepare reports on "the future of money", and to assess the prospects of a digital dollar.

ii) The United Kingdom

Economic Secretary to the UK Treasury John Glen MP had already announced in 2021:

iii) Europe

In July 2021 the European Central Bank (ECB) announced it was actively looking into creating a digital version of the euro.

iv) Canada

In March 2022 the Bank of Canada reported:

“The Bank of Canada and the Massachusetts Institute of Technology (MIT) today announced an agreement to collaborate on a twelve-month research project on Central Bank Digital Currency (CBDC)”

v) The G7:

A programmable digital coupon scheme (they call it currency) that hands total control to the state has already been announced by the G7, currently led by Britain.

vi) The UN:

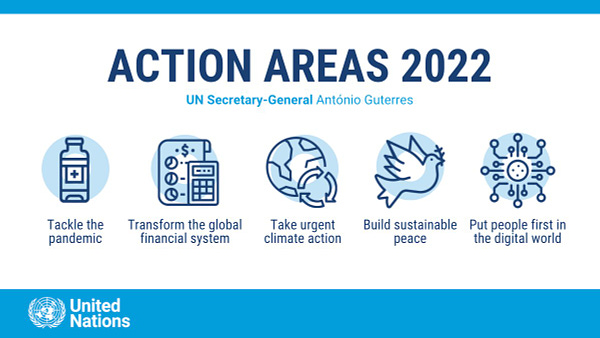

On 21st January 2022, UN head Antonio Guterres urged all member countries to go into “emergency mode” around five areas, which include: “Transforming the global financial system… putting people at the centre of the digital world”

You should read this as him demanding a digital ID for every single person on the planet - as an “emergency” - linked to programmable digital coupons (or “currencies”) for food. This is the Chinese social credit system, and implies total state control.

The Bahamas, the Eastern Caribbean, Jamaica, Nigeria, and Sweden have all announced that they too are pursuing this path. India appears to have been slightly ahead of the game:

In fact, and according to the Atlantic Council’s CBDC tracker, around 80 countries are currently actively exploring digital coupons (or “currencies”) backed by their central banks.

vii) The People’s Republic of China

China became the world's first major economy to pilot a digital coupon (or “currency”) in April 2020. The People's Bank of China is aiming for widespread domestic use of the e-CNY, or digital yuan, in 2022.

viii) The Russian Federation and US Sanctions

Due to the ongoing war in Ukraine, the US and her allies have imposed sanctions on Russia, expelling Russia from the global SWIFT system of payments.

This has also encouraged open calls among New York City’s hedge funders for a run on Russian banks:

This carries the danger of crashing the Russian economy, triggering a global economic meltdown:

The war in Ukraine is the “inflection” point that Biden referred to above. US sanctions on Russia are so extensive that they invariably lead to the end of the US dollar based global financial system, agreed after World War II at Bretton Woods.

This means the end of the financial system as we know it:

Russia now appears set to abandon her dependency on the petrodollar, instead relying on her own financial alternatives.

Meanwhile, Russia's largest trading partner China, which has already launched its own CBDC, announced that their country's relationship with Russia has "no limits."

“Cutting some Russian banks’ access to SWIFT — the messaging network at the heart of global movement of money..will give other geopolitical rivals, especially China, the excuse to promote digital versions of their own central banks’ money in global trade and finance. That could weaken the dollar’s international clout.”

“To shrug off the yoke of CHIPS, China has readied its own Cross-Border Interbank Payment System. CIPS settles international claims in yuan and can potentially run its own messaging network.”

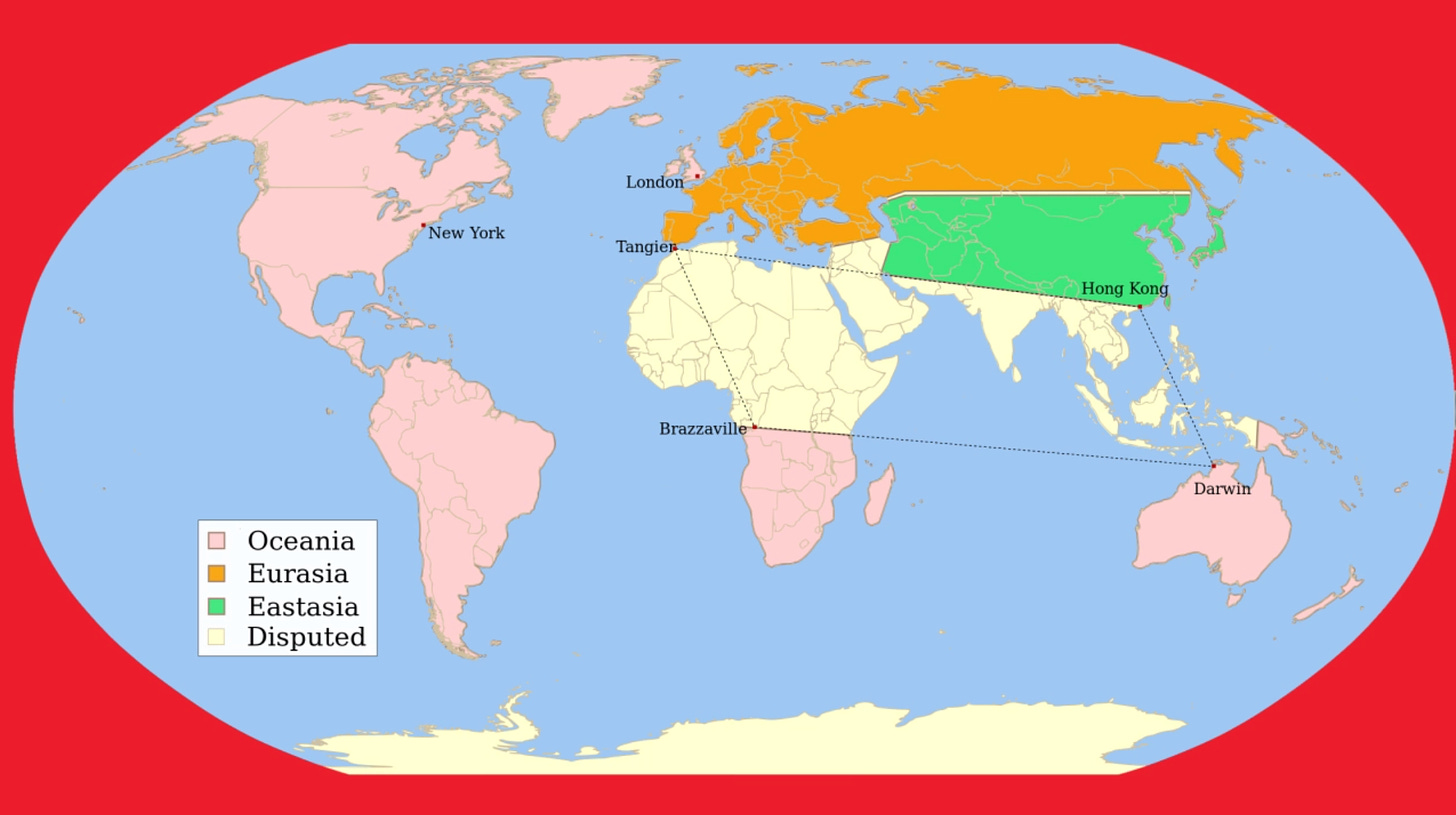

What all this means is that, as you are reading this Radical Dispatch, the world is cleaving along the lines of George Orwell’s dystopian vision of Eurasia, Eastasia and Oceania. Most of the lands that remain in “dispute” here happen to be Muslim-majority lands.

3) Why Does All This Matter?

If you believe the rhetoric of the World Economic Forum (WEF), all of the above changes are benign.

The reality is that never before in history has the world seen a control mechanism as complete, as total and as all encompassing as CBDCs. You should be very worried.

i) On Privacy

Once CBDCs are implemented, and cash erased, every single one of your digital transactions will exist on the public ledger, anybody can see them, forever. And unlike self-custodial decentralised crypto wallets, central banks seek openly to have access to your CBDC wallet by tying it to a state-issued digital identity.

”What CBDC research and experimentation appears to be showing is that it will be nigh on impossible to issue such currencies outside of a comprehensive national digital ID management system. Meaning: CBDCs will likely be tied to personal accounts that include personal data, credit history and other forms of relevant information.”

As I sought to warn on my appearance with Joe Rogan, this is why governments were stubbornly insisting on setting up a vaccine passport infrastructure long after the rest of us had already realised that vaccine passports do not stop infection or transmission of Covid.

What we are living through appears to be a global bankers’ palace coup, seizing power from governments, where they had once granted an illusion of people’s power.

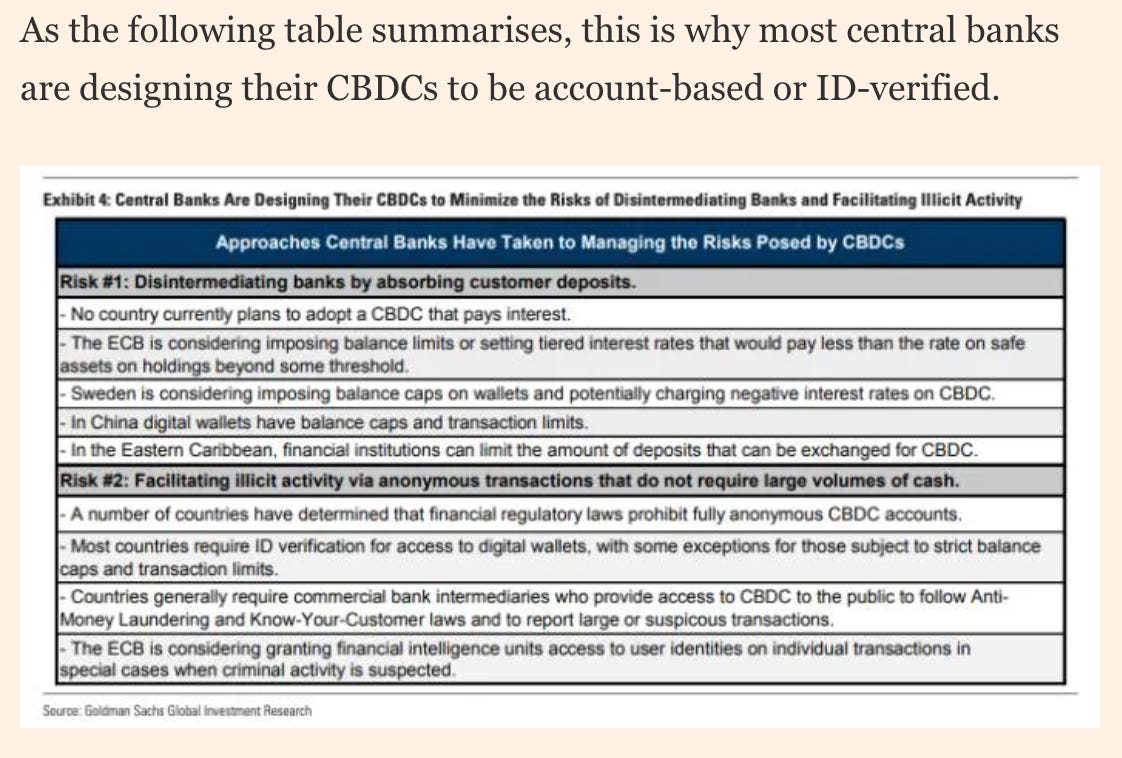

“. . . central banks have designed their CBDCs to not pay interest or are considering setting a penalty on holdings above a certain threshold. Some central banks have also imposed caps on total balances or allowed commercial bank intermediaries to limit the degree to which customers can exchange existing deposits for CBDC…central banks have mostly decided against fully anonymous accounts or have capped the size of anonymous transactions. Governments have varying degrees of insight into transactions and have generally put the burden of monitoring CBDC customers and transactions on commercial bank intermediaries.”

The Financial Times continues:

“When money goes ID-based, one also has to consider the broader parameters of the potential data creep. Just how far should that personal file reach? What sort of non-monetary information should or shouldn’t be contained within it? To what degree should account-holders be able to refuse access to their data to third parties? Who might the government entrust to manage and operate these schemes, and how can we hold them to account?”

ii) Control

But privacy is the least of it. There are graver concerns around CBDCs being programmable. Unlike decentralised crypto and cash, these digital coupons (or “currency”) could be pre-programmed to allow only the purchase of goods and services that are approved by the central bank, the government, or your employer.

To quote at length from this Telegraph article:

Agustin Carstens, head of the Bank for International Settlements (BIS) said:

“The key difference [with a CBDC] is that the central bank would have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and the have the technology to enforce that.”

“According to Agustin Carstens, head of the Bank for International Settlements (BIS), central banks cannot give up their role as guardians of the global financial system in favor of private cryptocurrencies”

iii) Permanent Serfdom

Once cash is removed, and if there is no alternative fungible token, the implementation of programmable digital coupons (or “currency”) will lead to the permanent serfdom of humanity.

Such is the all-pervasive control possible through CBDCs, that money could even be set to be conditionally released, upon proof of adopting certain behaviour.

John Cunliffe, deputy director for the Bank of England, told the Telegraph:

“You could think of smart contracts in which the money would be programmed to be released only if something happened.”

By such means, choice could be remove altogether. A negative test, a vaccine, a booster or any other pre-required behaviour could become a condition for unlocking your wages. This is total slavery.

It is otherwise known as the Chinese Social Credit System:

Your purchases could be curtailed or conditional to your carbon footprint:

Canada’s official reaction under PM Trudeau to the truckers convoy has already served as proof of concept:

Just a month ago, the government of Canada was tracking down Freedom Convoy protesters – and even those who just donated money to the protests – and ordering banks to freeze their assets.

Under such a system, not only would it be easier to seize people’s assets for ‘wrongthink’, but people could be barred from donating to causes deemed “wrong” in the first instance. Being “programmable”, their digital coupons (“money”) would simply not work. Subscribing to independent news analysis such as The Radical Dispatch could become impossible, simply by algorithm.

Developing countries in particular will be hit the hardest. World Bank Group President David Malpass has already stated that developing countries will be ‘helped’ to recover from the devastation caused by global lockdowns. This ‘help’ will be provided on condition that the World Bank’s proposed reforms are implemented, along the lines of the Great Reset. In return for debt relief, globalists will be able to further dictate national policies and curtail national sovereignty.

4) Ukraine is Ground Zero

Truth is the first casualty of war. Behind the smoke and mirrors the battle being waged in Ukraine is connected to ‘the Great Reset’.

In early July 2021, Ukraine’s parliament passed a law regulating payment methods that listed a future CBDC in the same category as cash or electronic money. In late July, Ukrainian President Zelensky signed into law a bill that would allow the NBU (Ukrainian Central Bank) to issue a CBDC.

The money men have already noticed how Ukraine is ground zero. Most news originates in reporting the consequences of decisions made by global finance.

“The war between Russia and Ukraine has heralded the end of globalization, as the conflict has upended the current world order that has been in place since the Cold War and will have lasting global economic consequences, warned BlackRock CEO and Chairman Larry Fink in a letter to shareholders on Thursday.”

“The billionaire head of asset management company BlackRock says the Ukraine war will accelerate digital currency adoption. In a letter to shareholders, CEO Larry Fink asserted that the war “will prompt countries to re-evaluate their currency dependencies.”

By introducing Universal Basic Income (UBI) to each citizen in the form of digital coupons (or “currency”) connected to a digital identity that stores health data as a prerequisite for compliance, the social credit system is effectively being introduced in Ukraine.

5) But What To Do With Bitcoin?

How can global finance appropriate the desire for decentralised digital currencies like Bitcoin, while avoiding the accompanying loss of control over international monetary policy? Well, some countries are trying to ban the exchange of Bitcoin as a solution.

“Egypt, Iraq, Qatar, Oman, Morocco, Algeria, Tunisia, Bangladesh, and China have all banned cryptocurrency. Forty-two other countries, including Algeria, Bahrain, Bangladesh, and Bolivia, have implicitly banned digital currencies by putting restrictions on the ability for banks to deal with crypto, or prohibiting cryptocurrency exchanges…The number of countries and jurisdictions that have banned crypto either completely or implicitly has more than doubled since 2018…Some governments that have banned crypto have said that…the rise of crypto could destabilize their financial systems”

Coindesk reports on China:

The National Development and Reform Commission (NDRC), the highest economic planning agency under the State Council of China, has banned crypto mining. At the time, this crackdown facilitated a 50% drop in Bitcoin’s value though in the long term Bitcoin continues to grow.

Realising the dangers, Russia is attempting the same. The regulator has already stated their intention to ban cryptocurrencies. The Bank of Russia has started a pilot stage for the digital ruble, its own central bank digital coupons (or “currency”) (CBDC).

Coindesk reports on Russia:

All this, however, as Bitcoin floods Ukraine.

While countries simultaneously seek to ban decentralised crypto currencies everywhere, people are recognising its value as a dependable means of exchange in conflict, even as their national currency fails. This could be seen as a proof of concept. Global finance will not like that. One solution for the money men would be to encourage nation states to roll out CBDCs, offering them to the public as if they are “crypto”. Meanwhile, and because decentralised crypto currencies such as Bitcoin cannot simply be erased from the internet, Big Finance will seek to sweep up as much Bitcoin as possible. This strategy creates ‘whales’ among traditional money men, who then have the power to destabilise the market due to their large market share. Whether it will work is another story.

“BlackRock is by no means averse to bitcoin, cryptocurrency, or its underlying technology. In January of last year, Be[In]Crypto reported that BlackRock was seeking to buy bitcoin.”

6) Waking Up

Increasingly, people from all walks of life are awakening to the danger.

Too many have already been creeped out by the WEF message. Remember, “you will own nothing, and be happy.”

No wonder the World Economic Forum took the above video down from youtube here, and from twitter here. We rumbled them. Now we must stop them. The decision for a centralised, controlled and authoritarian future, or a decentralised, liberated and free future rests with us, the People.