The Radical Show Podcast 22

At the top of this newszine Resistance Radio is pleased to present full members of Radical Media with the Radical Show podcast 22. On 18th September 2022 we spoke again to the former global head for respiratory illnesses at Pfizer, the whistleblower Dr Mike Yeadon: On Building Back Better, First By Destroying.

Resistance Radio podcasts are for full members of Radical Media. Basic members may upgrade their membership here:

The rest of this Newszine is free for all. Do read on.

UK Government Opens 'Head of Central Bank Digital Currency' Job Application As Bank of England Recommends Adopting Digital Pound

- A Radical Dispatch

1) New Job: UK Head of CBDCs

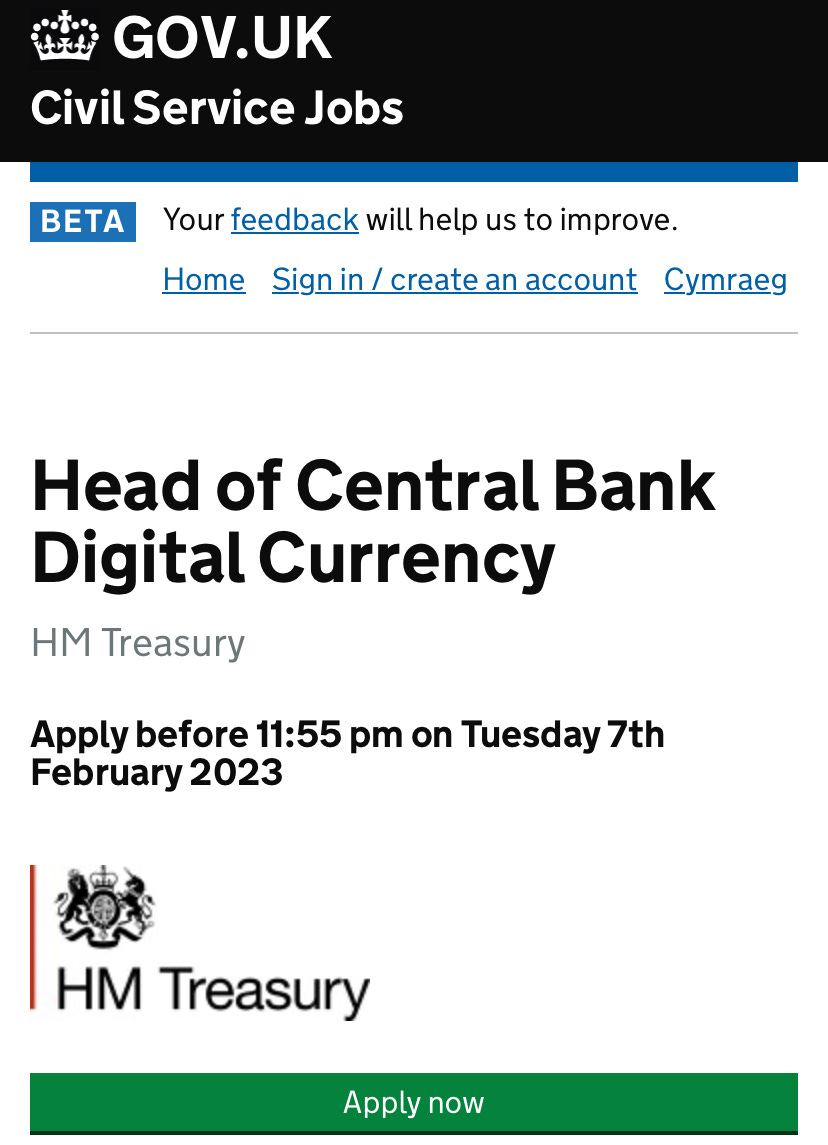

The British government officially opened a new job position for Head of Central Bank Digital Currency (CBDC).

Yes, they really did.

Applications have now closed, though the search results remain.

And the entry also remains on Linked in.

As Coindesk reports 24th January 2023:

“The successful candidate will be responsible for leadership of HM Treasury’s work on a potential digital pound – a U.K. central bank digital currency (CBDC),’ reads the posting.”

2) The Warning

Regular readers will recall that we warned of precisely this development over a year ago on the Joe Rogan show.

It is worth a recap.

Part 1:

Part 2:

Part 3:

3) Bank of England Recommends CBDCs

Yesterday, 7th February 2023 the Deputy Governor for Financial Stability at the Bank of England Jon Cunliffe gave a speech presenting the official recommendation of the Bank of England that the UK adopt a Central Bank Digital Currency (CBDC).

In this speech, the Deputy Governor for Financial Stability at the Bank of England Jon Cunliffe made clear that a CBDC for the UK is not only their preference, it is also likely.

“Our assessment is that on current trends it is likely that a retail, general purpose digital central bank currency - a digital pound - will be needed in the UK.

..The Taskforce’s conclusion is that we are not yet at a point where a firm decision can be made to implement a digital pound.

However, in view of the likely need and the lead time to introduction, the Bank and The Treasury, will now proceed to the next stage of detailed policy and technical development of the digital pound - including the development of a technical blueprint..

..The work over the next two to three years will inform that decision and will reduce the lead time to launch should the decision at the end of this stage be to implement the digital pound in the UK, which could then be introduced in the second half of the decade.”

The Times of London reports 6th February 2023:

“A safe digital pound that can be used in shops or online is likely to be needed to cut the risks posed by a form of private money that could be launched by Big Technology, the government has said..

..Essentially, the appeal of a central bank currency is that if there were a banking crisis, the money would be safe. The Bank thinks that people will see digital pounds as safer than holding cash or commercial bank deposits because they will trust the central bank in a digital world…

..China and India have piloted versions of central bank digital currencies, while the US Federal Reserve and European Central Bank are working on blueprints..

..The UK government thinks the project would ensure the privacy of users but not full anonymity, amid concerns that consumers would be wary of transacting in a currency overseen by the central bank.”

4) The FTX Collapse Pretext

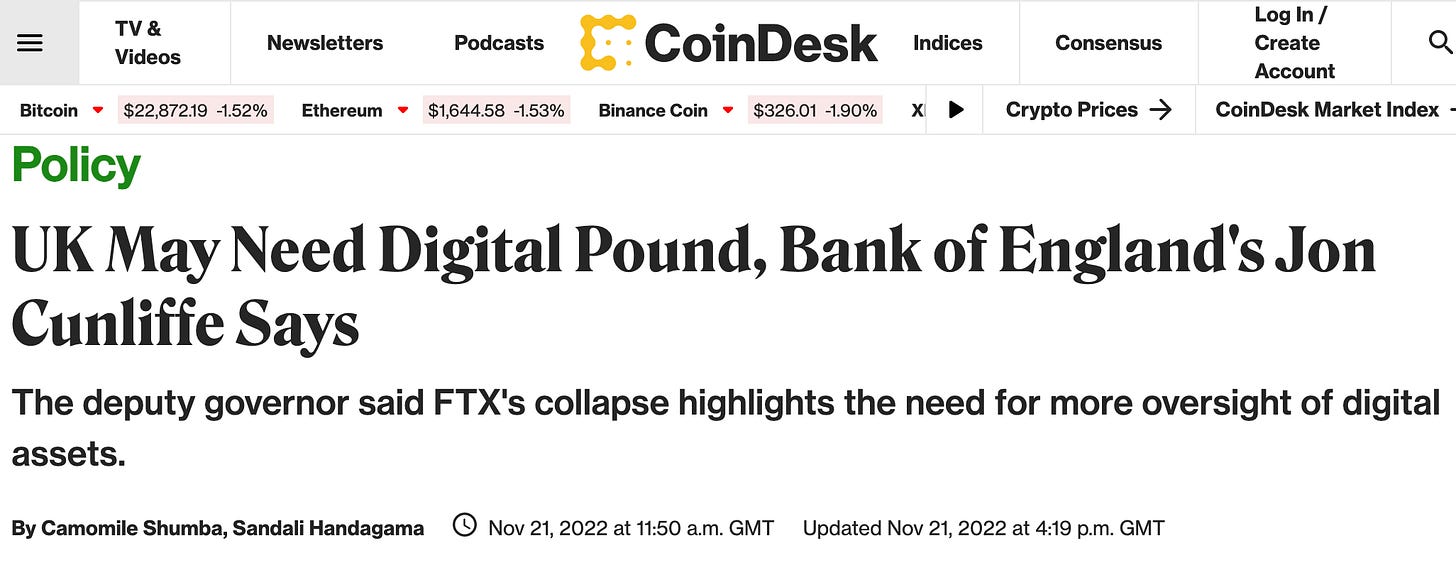

Last November 2022 the Deputy Governor for Financial Stability at the Bank of England Jon Cunliffe hinted that the collapse of FTX highlights the need for a digital pound, and more oversight.

Coindesk reports 21 November 2022:

This is also just as we warned.

The Radical Dispatch reports 15th November 2022:

Jon Cunliffe reiterated this point in his Bank of England speech yesterday:

“The majority of cryptoassets are highly speculative assets, whose value is extremely volatile, because there is nothing behind them. They have no intrinsic value. For that reason, they are not suitable and not used for general payment purposes. One can think of them as more akin to a bet than to trusted money. The digital pound would be a safe, trusted form of money accepted for everyday transactions by households and firms, in the same way as Bank of England notes are today…”

5) Programmable Money

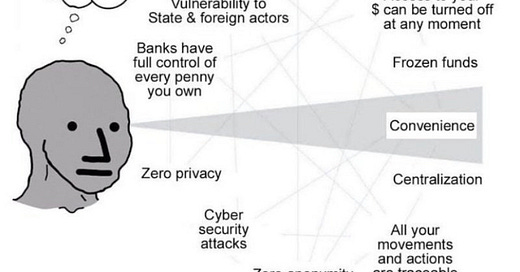

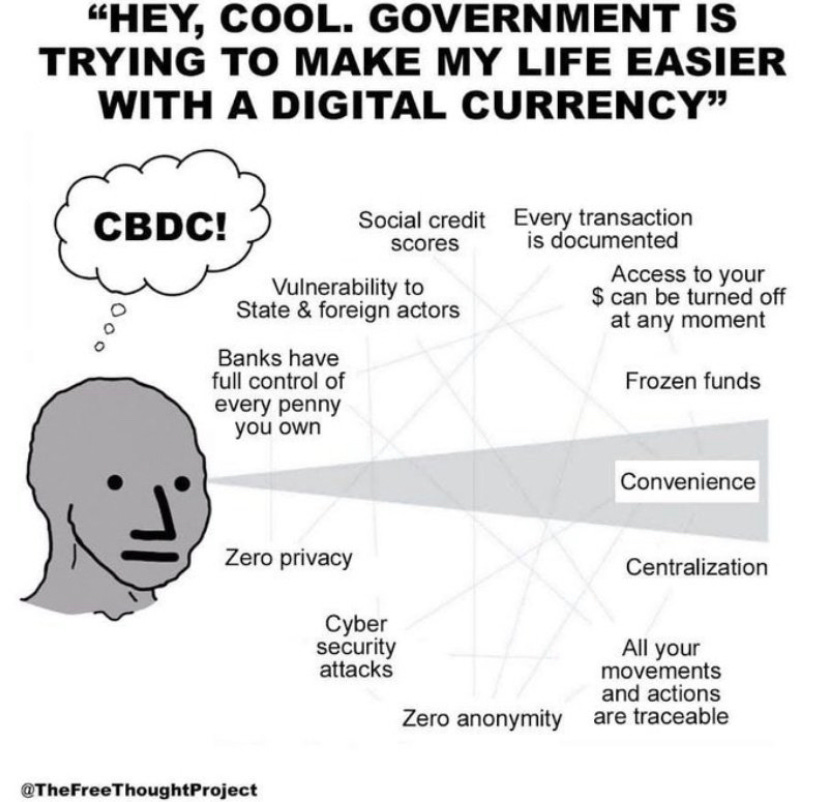

Of course regular readers will be aware of our concerns here at Radical Media about the dangers of CBDCs being programmable, hence leading to a total loss of liberty.

As we already forewarned in the Radical Dispatch 26th March 2022:

Agustin Carstens, head of the Bank for International Settlements (BIS) has already made their position clear on this:

Again, Jon Cunliffe made clear in his Bank of England speech yesterday that the CBDC would be held by the Central Bank directly:

“All of the digital pounds would be held on the Bank of England’s central ledger.”

Cunliffe also reiterated again the programmable nature of CBDCs:

“Programmable money, for example, could enable the development of smart contracts which carry out specific actions based on pre-defined actions and conditions”

*Footnote from Bank of England transcript: Some examples of programmable functionality might include: instantaneous currency exchanges with reduced settlement risk; more efficient real estate purchases whereby all parties’ transactions are executed simultaneously by a smart contract; or an automated payment made by a vehicle at a toll booth.

And though Cunliffe attempted to caveat that such programmable features would require ‘user consent’:

“Neither the Government nor the Bank would program a digital pound or restrict how it was spent. Instead, the Bank would provide the infrastructure and minimum functionality for the private sector to provide programmability features for users. Those features would require user consent.”

The centralised ability to restrict use or to simply switch off the money entirely has already been shown to be possible in Canada and elsewhere.

And the fact that Jon Cunliffe himself has previously made the exact opposite demand on government does not bode well at all:

“Earlier this month Sir Jon Cunliffe, a deputy Governor at the Bank, said digital currencies could be programmed for commercial or social purposes, even down to the way children spend pocket money.”

6) Keep Cash Alive, King

In his same Bank of England speech yesterday Jon Cunliffe predicted that cash will become ‘increasingly less useful’

“In the mid-1960s, most workers were paid weekly in cash, and around 70% of the population did not have a bank account. Very few had access to credit or debit cards. Consequently, for every £100 of funds that people held to make payments, over a third would be held as cash. Nowadays, less than 5% is held as cash. Even 15 years ago, 60% of transactions in the UK used physical cash; pretty much everyone in this room would have carried enough for everyday transactions..

In 2021 only 15% of transactions involved physical money. Technology and the increasing digitalisation of everyday life has transformed the way we use money. Private commercial bank money accounted for 85% of the payments made by the public. Within that, debit and credit card transactions accounted for 69% of transactions. Contactless payment has made such transactions much easier for everyday life. And the growth of internet commerce has required the use of digital money..

Our assessment that a digital pound is likely to be needed is grounded first in the view that further decline in cash use and further development in the digitalisation of money and payments is likely .. As far as the decline of cash is concerned, the immediate response is to make sure cash will remain available to any and all that want to use it. The Bank has made clear that we will continue to produce it and the Government is taking powers under the Financial Services and Markets Bill to give the Bank of England and FCA new powers to ensure the future effectiveness, resilience, and sustainability of the cash ecosystem..

However, we cannot ignore the fact that the safest form of money, ‘public’ money, that it is to say money issued by the state for general use, will become increasingly less useful and useable and of shrinking relevance to a large part of the population…” (bold emphases ours)

This is just as our Radical Reaction stated 2nd November 2022:

British corporatist press appears sensitive to the scale of public concern over the end of cash.

The Daily Mail reports 7th February 2023:

7) Bank of England Consultation

Not to leave themselves open to claims of riding roughshod over public concern, the Bank of England has opened a public consultation on introducing CBDCs, despite appearances that by now it seems to be a foregone conclusion.

Jon Cunliffe stated in his Bank of England speech yesterday:

“The consultation will run for four months and end on the 7th June 2023. The Bank and the Treasury will then review the responses and consider whether changes to the proposed model are necessary. We will publish our response to the consultation.”

The Bank of England consultation paper upon which the speech was based can be found here:

8) Is This Your Hill?

Only one MP appears to have raised any objection to any of the above at all.

Everyone else in Westminster - across parties - appears bent only on humiliating Britain further as they all stand in ovation for the Great Distraction that is Ukraine’s Zelensky.

This author recalls a time when the British public came out to oppose the imposition of a mere tax. In doing so, they defeated an Iron Lady. Compared to that, CBDCs really should be a hill to die on.

Alas, perhaps some people are already dead.

Our mission is to bring you Radical Media for Radical truths that modern corporatist media seek to silence. We cannot do this without your support. Full members also receive the Radical Show podcast and other Resistance Radio broadcast content, exclusive instant updates, special offers on our upcoming Radical Media merchandise & products, and early access to tickets for events.

Please upgrade your membership and become a paying, full monthly member here:

Listen to this episode with a 7-day free trial

Subscribe to Radical Media - by Maajid Nawaz to listen to this post and get 7 days of free access to the full post archives.